Disrupting the Food Supply chain

How HelloFresh and Co are disrupting the food supply chain.

HelloFresh, Blue Apron, Home Chef, Marley Spoon, Plated, De Krat and many others are subscription meal-kit delivery companies. Companies that sell and deliver meal plans with the intention of making you an overnight cooking sensation.

While these companies are making individuals a chef to be reckoned with, they are also changing and disrupting the food supply chain.

Disrupting the food supply chain is no easy task, yet these companies are attempting to change in many ways how food is consumed. For a consumer you could briefly summarize it in by having a subscription there is no planning for dinner, hence no need for shopping, and no waste because the portions are exactly as they should be.

For start-ups though, to disrupt an archaic supply chain, requires effort, capital and a great quantity of planning. Throughout this article we will explore the processes companies like HelloFresh or Blue Apron have taken to disrupt the chain.

Traditional Food Supply Chain

The food supply chain, or any supply chain for that matter, is no more than getting a product or service to the final buyer. It involves many different processes and activities to get the final product to the buyer and it can be complex or simple depending on the stages or checkpoints it must go through.

In the food industry though, the supply chain process is generally complex and dynamic. Complex because it can involve resource intensive labor, technology to keep the food cold during transportation or because import barriers require the goods to get special clearance before it is allowed in the country. With dynamic we refer to that there are no stable factors with food production. This leads to price and resource fluctuations that influence the type of product and price you can find at your local grocery store.

Now before food actually arrives in your kitchen or favorite restaurant, it needs to go through a few checkpoints.

The beginning generally starts with raw materials. If we take as an example a farmer, a farmer can either decide by him or herself what to farm or have a forward contract with a buyer (also known as hedging its produce) or both.

Once the crops are ready to be harvested, the crops need to be prepared into food. It can, for example, go to a manufacturer whom will aim to utilize everything from the crop. The “edible” part of the crop may be used for human consumption and the waste can be shipped for other manufacturers whom may prepare it for animal food.

After the preparation stage, it will enter the distribution part. The goods get distributed and sold to companies that sell the goods one more time before consumption. Think or retailers or restaurants.

Lastly, when the food has arrived at the last stage, you and your fellow peers will be consuming it.

Now this a flat explanation. At any given point there can be another layer of processing or distribution before food lands on your plate. Moreover, every stage also has some type of sales and marketing involved.

Remember that big giants in the food industry will exercise their power to control all channels. Meaning that there are major hurdles to get into the chain when these corporations have locked the market with, for example, forward buying contracts or ownership of farms.

The meal-kit supply chain

The meal-kit changes a few key aspects of the traditional supply chain. We will look into this from different angles, so we can understand better the business model and how they actually work from a logistic, financial and marketing perspective.

Why these three? Well the logistics is mainly what make them “revolutionary”, finance because it is the blood of the company and marketing because they needed to sell something before they actually have it (subscription is no more than a promise to deliver).

Logistics

The process of getting meal-kits homeWhere companies like HelloFresh start their journey when making meal-kits, is not where you think of when looking at a traditional supply chain. These companies start their business in the kitchen. Preparing and testing the meals prior delivering them. A customer centric approach.

During the part of preparation, they look at aspects that influence the overall reception of the goods delivered. Generally, a platform or engine is used to fine-tune the meal and predict the success of certain dishes. This type of technology helps the company gather data that they can utilize in other markets.

During this stage meal-kit companies will investigate how a region likes certain dishes, the feedback they have gotten from previous dishes, ingredients they know are available (for price reasons), what season it is, the skills and cooking time it takes to prepare a meal and the dietary requirements to make you a healthy human being. After testing the dishes, they are ready to enter phase two.

However, before doing so, meal-kit companies will estimate the quantities and predict the costs of the raw materials and its availability. They use big data to make the best bet. Which explains why the margin on purchased goods of these companies can be so high (+/- 60%).

After the dishes have been selected it is time to deliver. The purchasing team will aim to buy the exact quantities they need for the meal-kits. By purchasing the exact quantities these companies do not have unsellable stock and they do not need to store the foods for a longer period. Generally, these companies approach producers between six to two months in advance.

Once the dish has been developed and the order has been placed. The goods leave the producer to either enter manufacturing or warehouse of the meal-kit delivery companies. Either way, the boxes get packed and then they get shipped to customers.

Generally, these companies will want to fulfill the order themselves (last-mile) or enter a branded partnership with a distributor. The last-mile is important for them, because it is part of their integrated marketing plan.

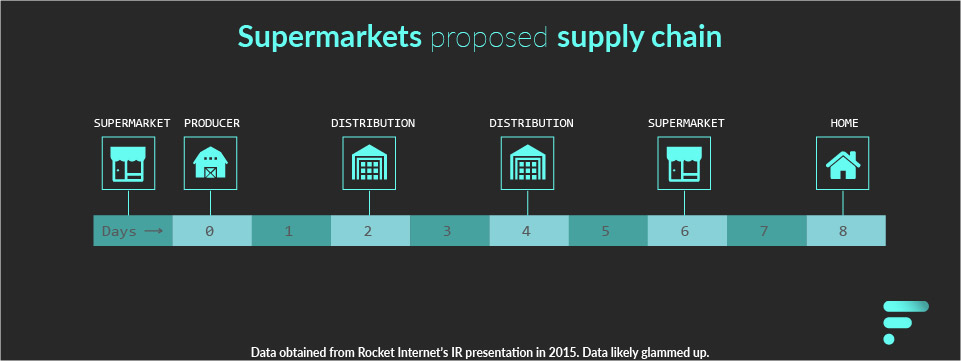

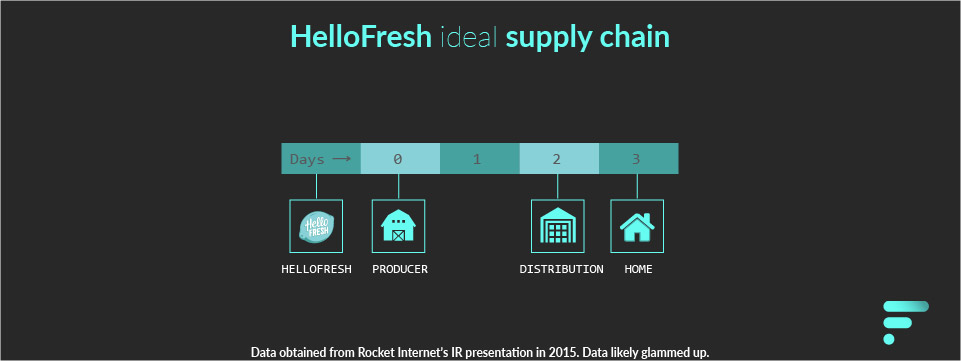

So what make these companies revolutionary in comparison to the traditional chain? They aim to reduce the number of checkpoints a product needs to go through before arriving to customers. By reducing the number of checkpoints, the margin increases for these companies, as there are less companies and processes involved.

Moreover, the least checkpoints the more control they exercise over the channels. Meaning that they can deliver faster to customer and can control the costs better. Which leads again to better margins.

Now what makes these companies even more interesting is the subscription model. Being able to predict demand based on subscribers makes the company less vulnerable for uncertainty. More importantly though, they can make predictions about the quantity of products they need for their meal-kits. Not only making these companies effective while purchasing but also destroying the burden of keeping perishable goods in stock. Which, again, lead to better margins. In other words see these companies as being able to sell something before they actually have anything to sell.

Finance

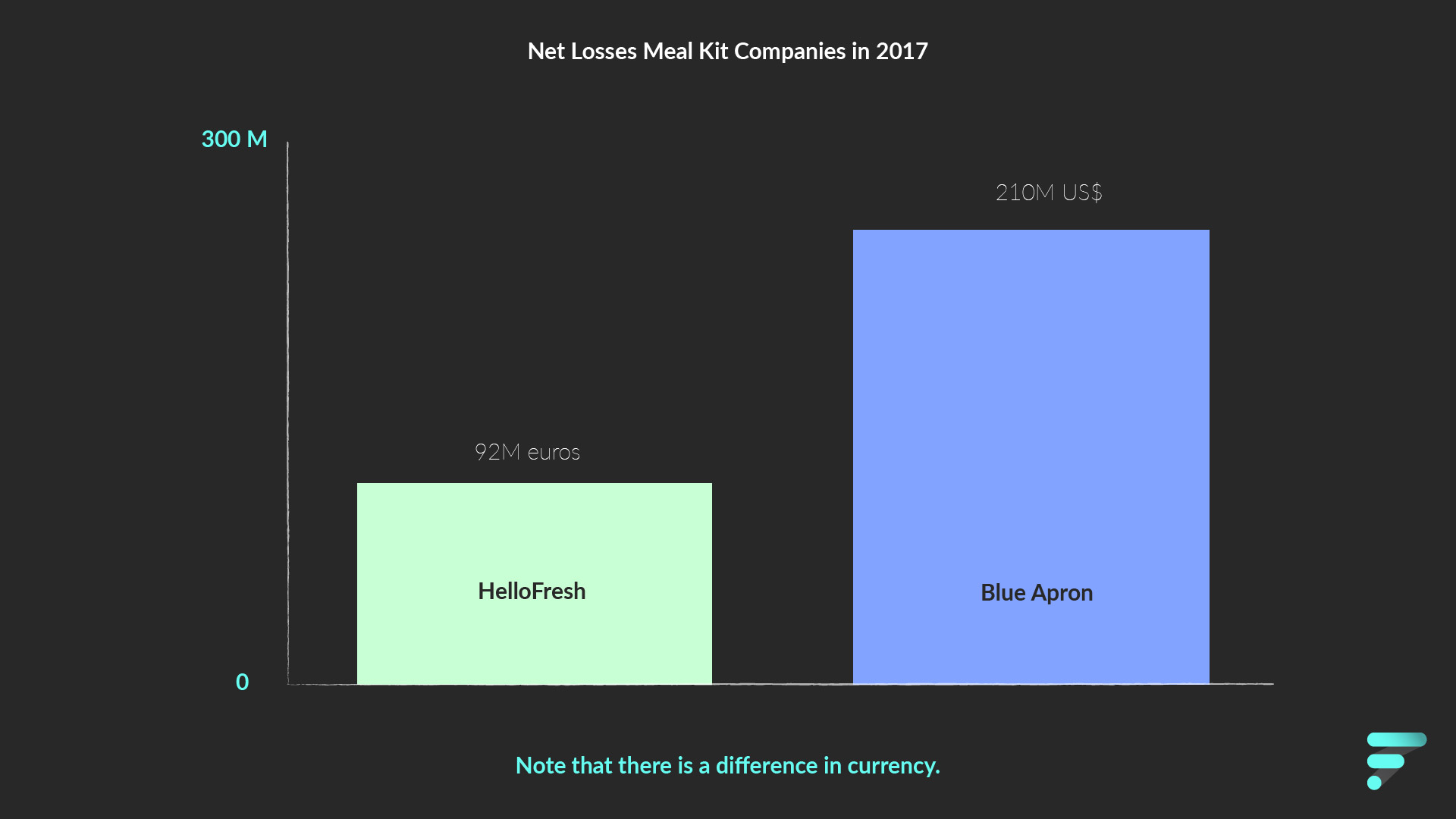

How the meal-kit companies blood flowsWhat many of these companies share with each other is the amount of loses they generate.

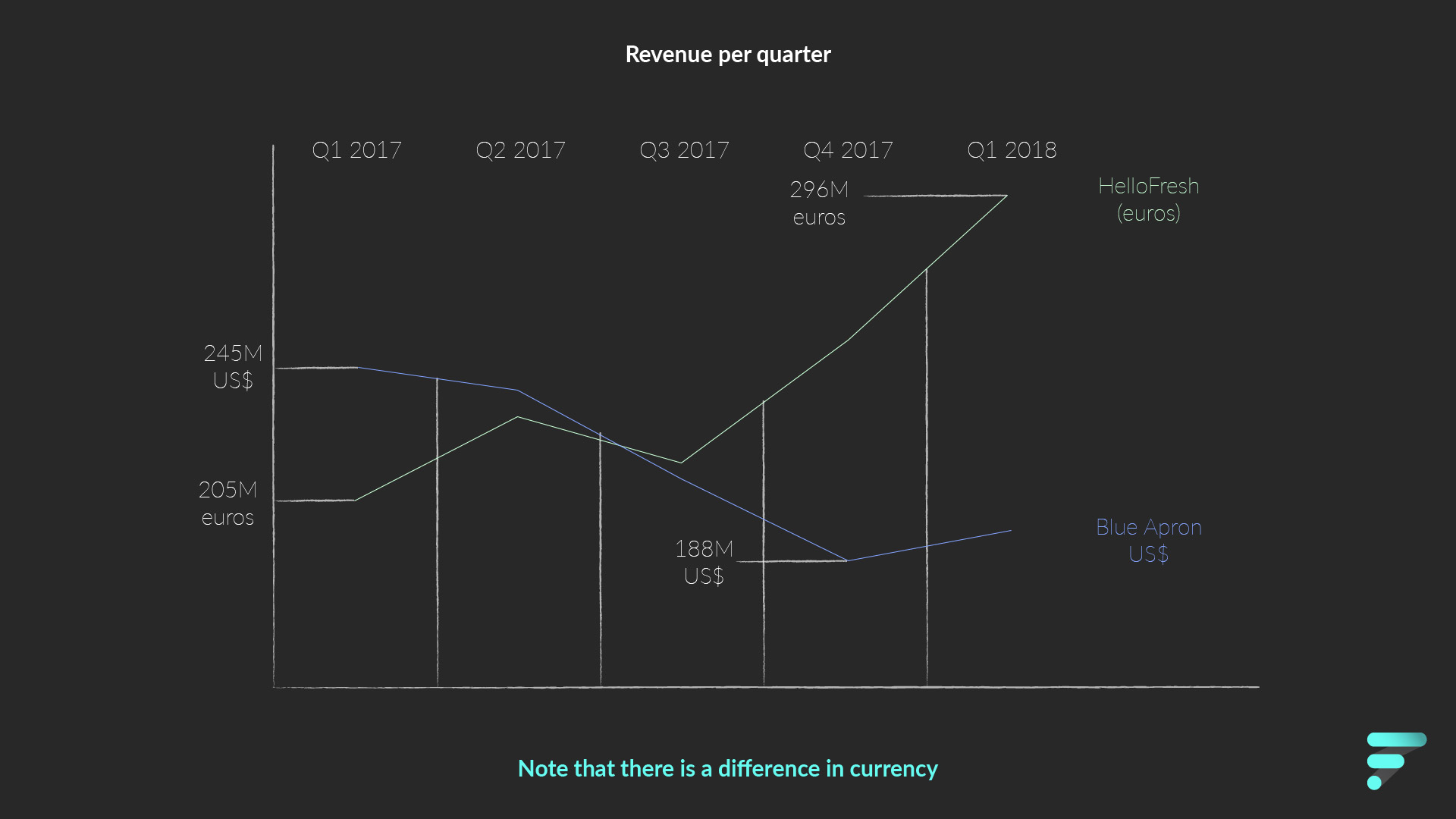

Nonetheless, one of these companies, HelloFresh, will likely reach the one-billion-euro mark by the end of 2018. Moreover, it is expected that HelloFresh will be the first one whom is profitable on at least one of the quarters during 2018.

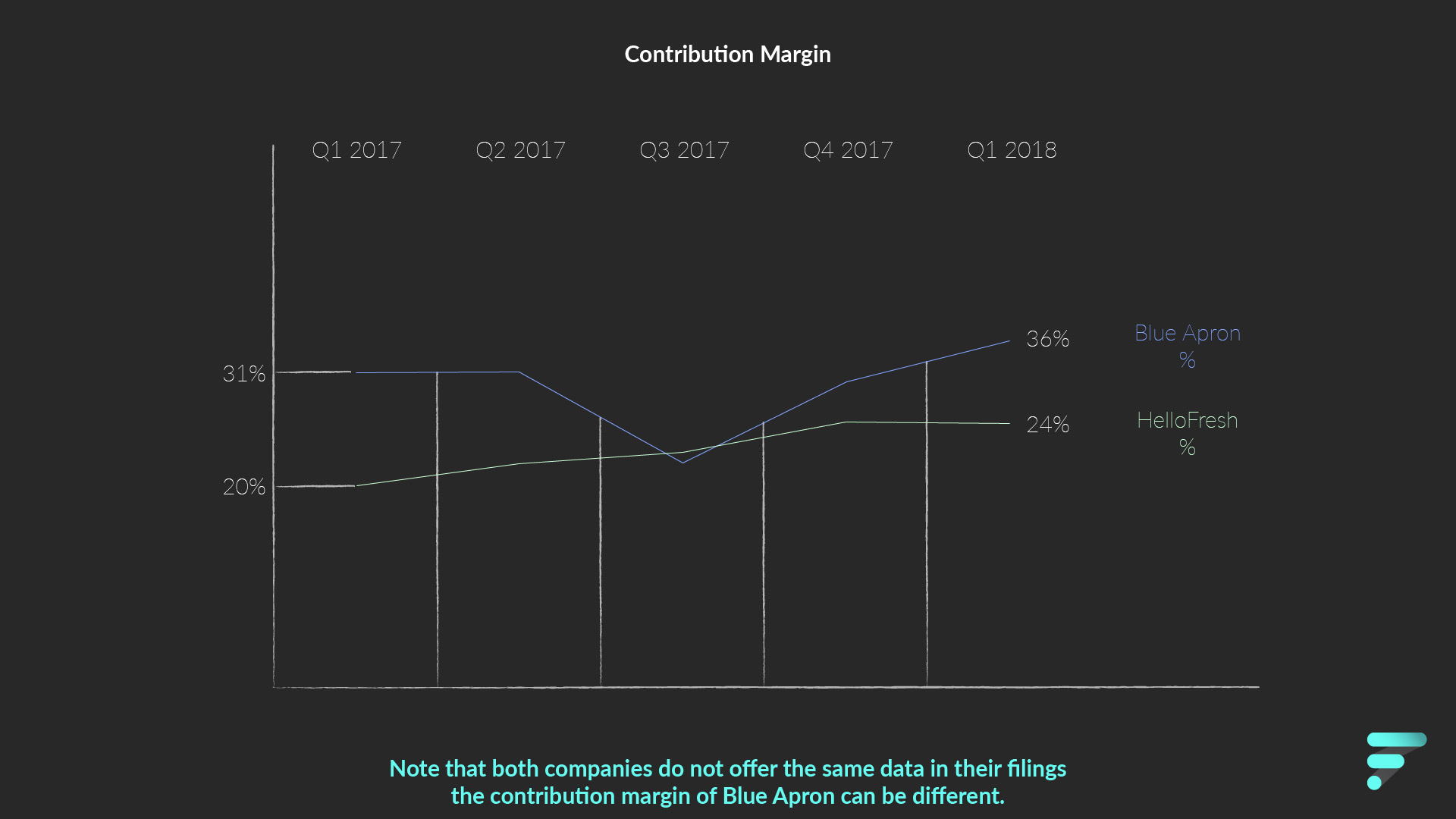

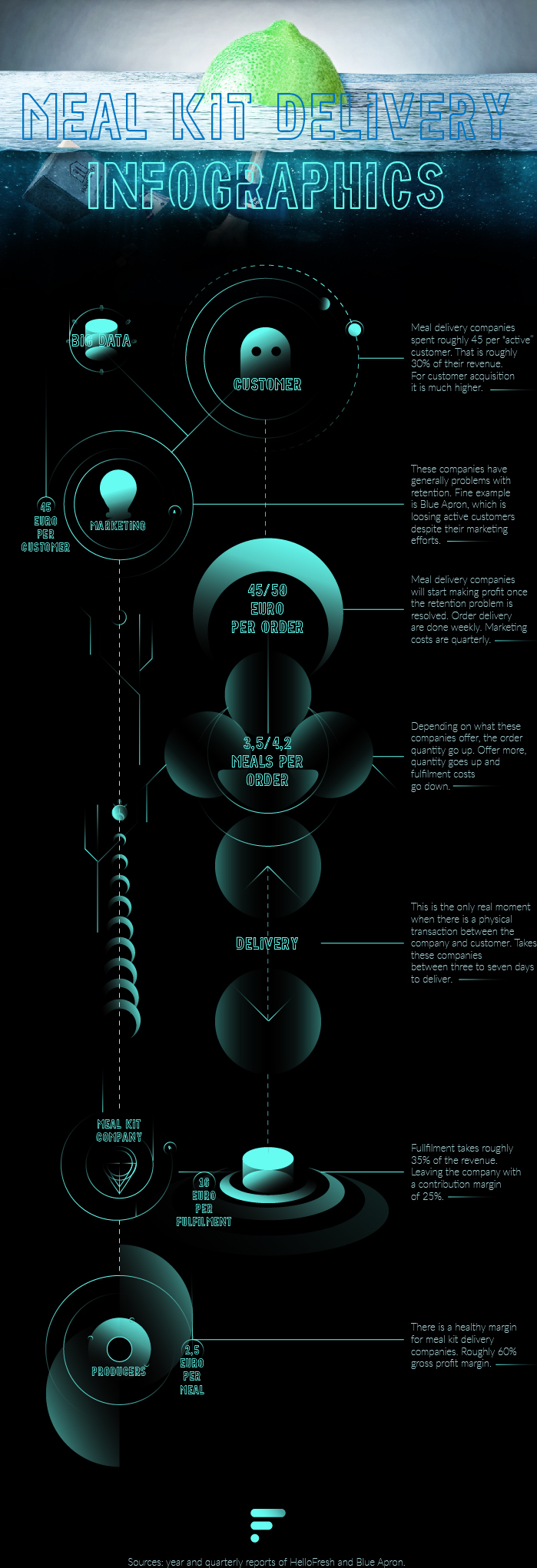

Despite the small size of the meal-kit delivery companies – in relation to other established companies in the food industry – the effectiveness of these organizations is obvious when they retain a gross profit margin of sixty percent. The contribution margin on the other hand levitates between thirty and twenty five percent, which is also pretty good considering that nearly all companies handle fulfilment for free.

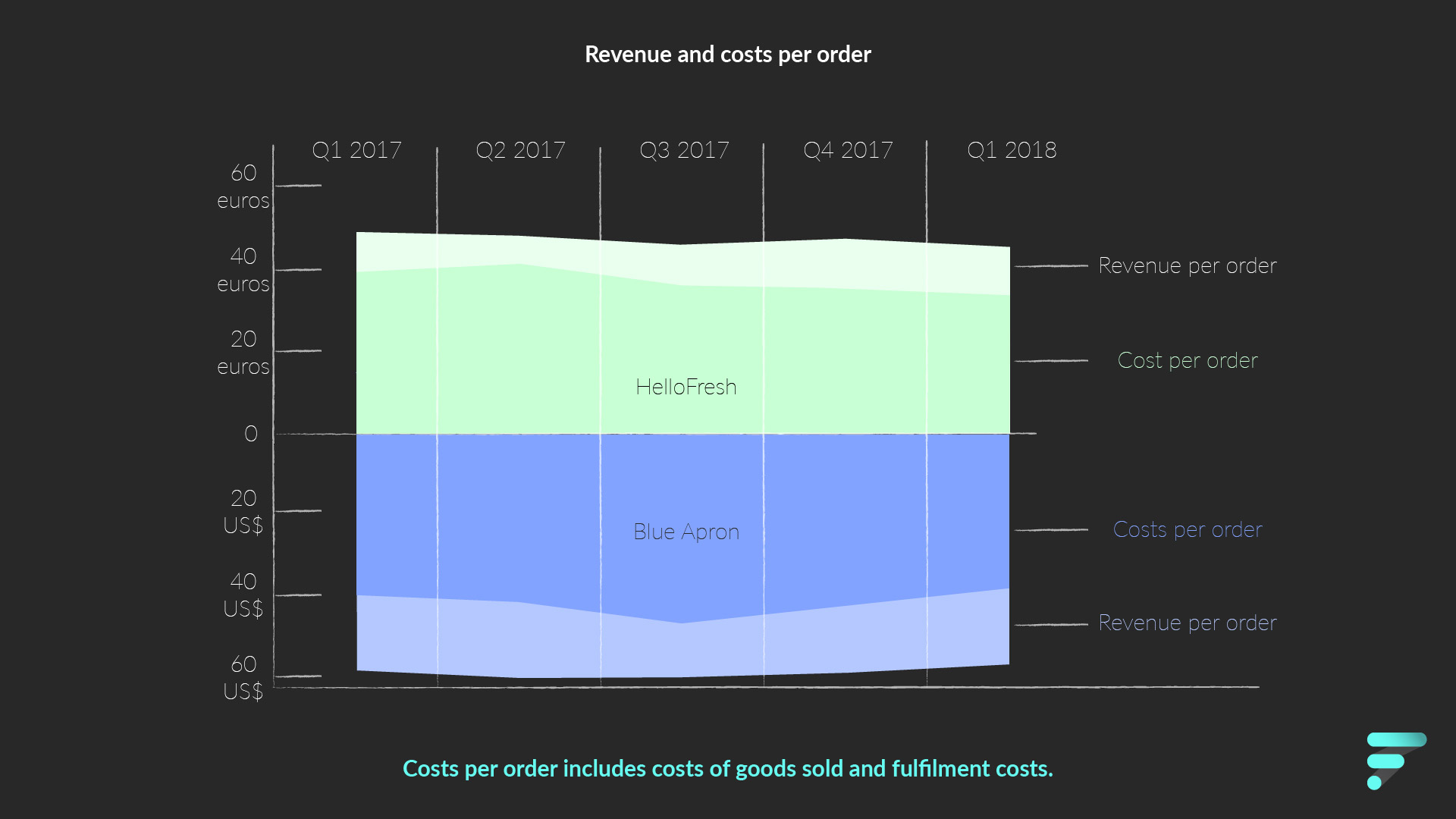

In numbers though, HelloFresh spends roughly 2,5€ per meal while fulfillment is close to 16€, with an average cost per order being 33€. For Blue Apron this is 37US$. This means that for these companies’ fulfillment has a much higher cost than the actual produces they sell. On the flipside, the revenue per order for HelloFresh is 45€ and for Blue Apron 57US$.

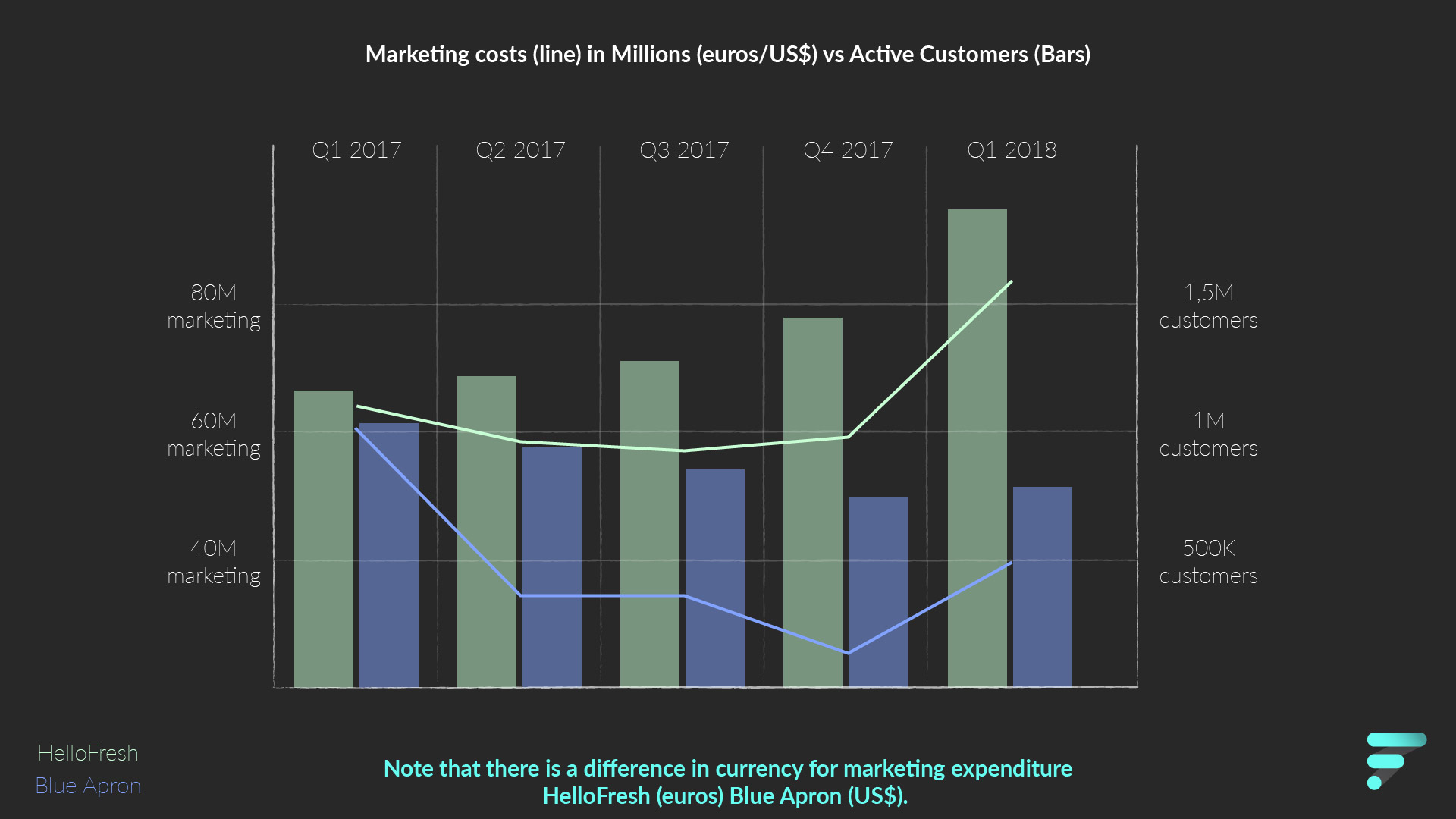

These companies generally leak money in the marketing department. HelloFresh spent roughly 28% of their revenue on marketing in the first quarter of 2018. While Blue Apron spent closely 20% of their revenue on marketing. Per client this would amount to 45€ for HelloFresh and for Blue Apron 50 US$. While the revenue generated per active customer per quarter are 157€ and 248US$ respectively.

Now, all of this would mean nothing without knowing more about retention rate and the actual cost of acquisition (for HelloFresh roughly 85€ and for Blue Apron 94US$). Both of which are a bit more difficult to calculate for Q1 2018 due to the limited information available and the scope of this article. Which is why I prefer flattening the figures to calculate how the marketing dollars are working on new customers.

What we will be looking at is the net growth of active customers per quarter and the marketing costs per new active customer. Or the poorman’s customer acquisition cost. What you get is that per every new net client HelloFresh had to invest 195€ while Blue Apron had to spend 983US$. Now, before the financial guru in you binds me on a wooden stake for blasphemy, hear me out.

What this this quick calculation tells you is that the costs on marketing are spiraling higher than the actual revenue gained from new acquisition. In other words, retaining clients is of essence for these companies to be able to generate enough revenue to survive.

When the marketing dollar does not affect the generation of new customers (like in some quarters with Blue Apron) the company is facing a massive problem because their marketing dollar has no effect on growth because they are unable to either retain older clients or bind new clients. The results thereof are that these companies are reliant on marketing dollars to keep the revenue up.

Keep in mind though, that the calculation made above does have some serious problems relating to the distribution of marketing dollars. In case the financial guru in you does not want to put me on a wooden stake, let me explain why it should. The costs of marketing should be distributed between all customers and not necessarily the net new ones. I use it as a proxy to make a point.

Both Daniel McCarthy and Babak Azad have made some pretty solid cases about the retention problems and the cost of acquisition for HelloFresh and Blue Apron.

Finance, so what?

So, what has finance to do with disruption of the supply chain? Well, these companies have shown with their figures to be quite versatile with their approach to supply chain. These companies tailor their entire production to satisfy the end consumer. The result thereof is that their supply chain is designed to be efficient for the final buyer and nothing else.

This means that meal-kit-delivery companies will want to purchase the goods directly from the producer, package the goods and ship it off as soon as possible. By doing so they cut drastically the costs down of storage and transportation. Something supermarkets can become jealous off.

Moreover, they are able to predict the quantities of orders they need to fulfill, which allows them to purchase the exact amount of ingredients needed for the meal-kits. This results in the company being able, on paper, to sell all resources they have purchased. At the same time, they eliminate waste that the food industry is plagued by.

If you pair the above benefits with the economies of scale that will happen in the future, their margins will become better. However, do not expect to see those back in your monthly meal-kit bill though, that is the profit that investors are seeking.

The numbers also show the pain points of these companies. Fulfillment is for all these companies one major problem. The costs of delivery per order can be between fifteen and twenty euro’s. Which explains why these companies can eventually charge for delivery or try to search for other distribution alternatives. Like offering their goods in supermarkets or locations where you can pick up the box. Or increasing the order value by including lunch and breakfast in their plans.

Companies whom have adapted their strategy, are Plated which have meal-to-go in supermarket and also deliver the meal-kits home. HelloFresh is another example, they closed a deal to in over 600 stores in the US, that are owned by Ahold/Delhaize. In the Netherlands (Plus) and in Belgium (Delhaize) they offer to-go meal-kits too.

Another painful point is the costs of customer acquisition and retainment. The marketing costs of these companies are relatively high. Procurement and retainment seem to be the largest problem of these companies, which will make them look for cheaper or more convenient ways to promote or sell their goods.

Now real disruption has only a limited date on it. Eventually, other players will either enter the market or old players get bought by larger companies. Examples of these are Plated that was bought by Albertsons, Home Chef being bought by Kroger, Walmart whom entered the meal-kit playground, or even Unilever which invested in Sun Basket.

Despite companies believing their own marketing story, they will know that competitors will press shortly thereafter. Be it by selling out or by being outcompeted by other companies. In the case of HelloFresh, they were not able to get a deal off the ground with one of the largest supermarkets in the Netherlands Albert Heijn (Ahold), because they likely did not want to cannibalize on their own meal-kits. Moreover, it does not take a genius to understand that these types of companies will affect your food sales.

Marketing

Meal-kits the service nobody knew they wanted

For a meal-kit delivery company marketing is one of the essential pillars to reach the end of the supply chain. Without creating awareness that lead to client activation the company has not proven that its concept work or will ever work.

Rewind back to the early 2010’s, when meal-kit companies have not proven to be existent worthy. Supermarket formed part of the routine of many people. In densely populated areas supermarkets can be encountered five to ten minutes from any given point. In less densely populated areas, supermarket amenities can be found relatively close-by. If you would ask any random supermarket customer about the benefits of a meal-kit, they would not understand the concept or why they would need a subscription to get food nor the benefits it could offer.

Moreover, a subscription may seem like something you need commit to for a longer period of time, like a gym membership. Meal-kit companies needed to change and break habit in order to create the final link to the customer.

Now changing habits requires marketing capital and the ability to offer a better proposition than what supermarket can offer. Now, supermarkets have always been a convenience shop. Which explains why not much has changed for costumers in the supermarket formula other than consolidation and efficiency.

So how do you turn habit with marketing? You generally start with research and figure out what type of wrinkles you need to iron out before you have a viable product. In the case of HelloFresh, this started with talking to people to figure out what objections potential customers have with purchasing a meal-kit. When you understand the pain-points and objections potential clients have with your concept you can start firing those promotion bullets.

You are not every week at home? You can stop the order a week in advance. You prefer to cook something that is more your style? Sure, you have a selection of X amount of meal-kits. You are afraid of being stuck with a subscription for a long time? No worries, you can cancel anytime. Not entirely sure if it would fit your lifestyle? Your first box is nearly for free, just try it.

You get the point, ironing out the wrinkles allows these companies to understand customers better and capture the value that understanding brings.

Once all that has been figured out, the final part of the supply-chain has been closed.

The next step for these companies, supply-chain wise, is to make supermarkets altogether irrelevant by offering breakfast, lunch, dinner and a midnight-snack – at the end of the day it is cheaper to develop more business from existing customers. Try to create awareness that costs little marketing dollars, like for example working with supermarkets (see the contradiction there). Consolidate the supply-chain and create value from economy of scale. Or, perhaps, open to new different geographical areas, markets, regions or target group.

Looking for an infographic that is more business centric? Reach out to me to receive it.

Share this Page