Seven Unicorn Questions

Questions every business should answer.

Even though the title implies differently, the seven questions examined in this article are not a recipe for creating a unicorn company. Many stars need to align for an entrepreneur to have a unicorn company on their hands. Answering seven questions positively is still a galaxy away for the creation of a billion-dollar company. However, it is a good start for any entrepreneur that want to understand better the position of a company and how that translates into economic profit.

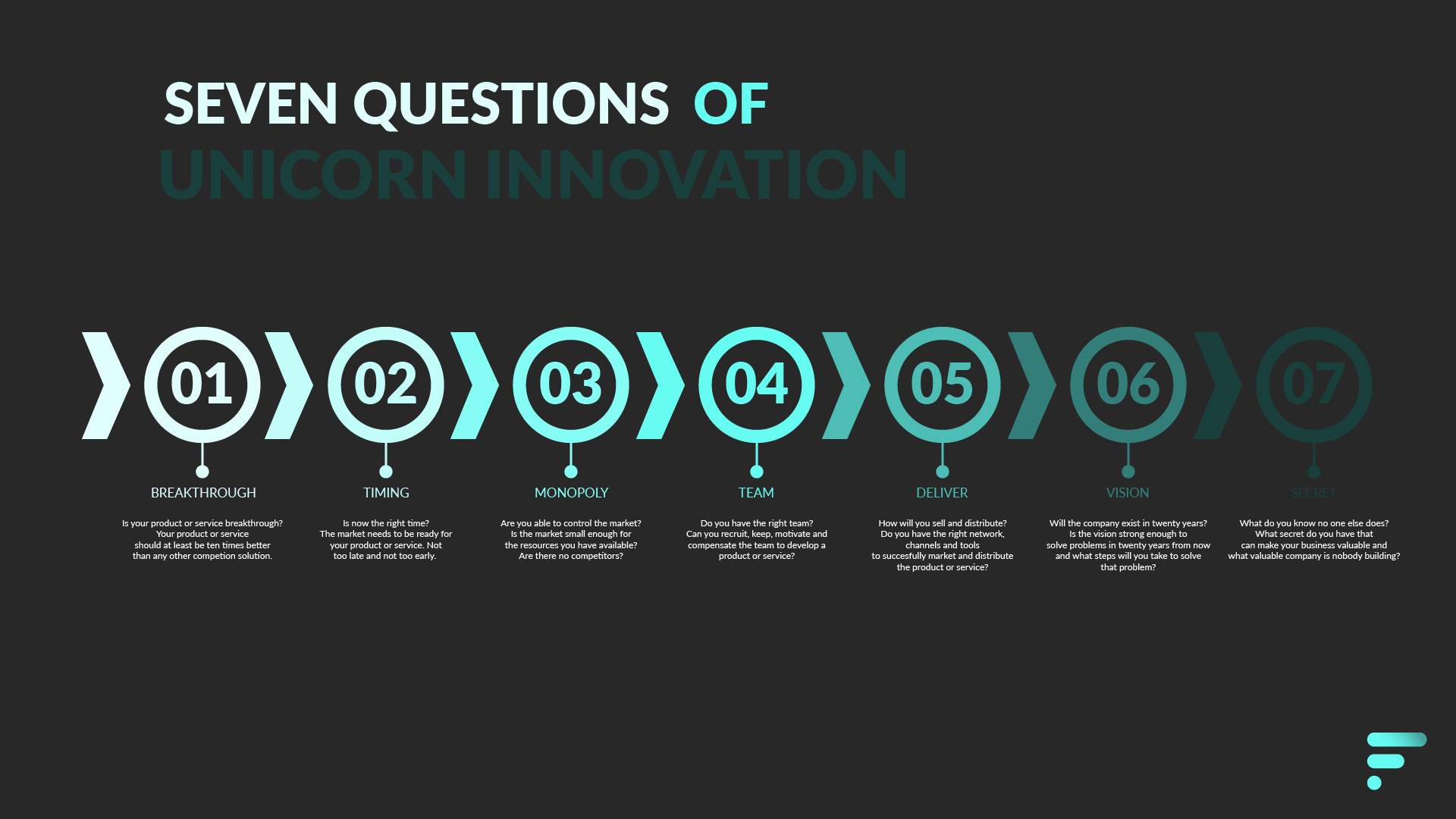

The seven questions can help understanding what aspects are quintessential for a company. In other words, these questions can help identify the potential of a business and if it is innovative enough to secure its place. The seven questions explored in this article are:

- Can you create breakthrough technology instead of incremental improvements?

- Is now the right time to start your particular business?

- Are you starting with a big share of a small market?

- Do you have the right team?

- Do you have a way to not just create but also deliver your product?

- Will your market position be defensible 10 and 20 years into the future?

- Have you identified a unique opportunity that others do not see?

This article leans heavily on the seven questions Peter Thiel and James Blake explore in the book Zero to One.

Throughout this article we will explore other ways of looking at these “prime” questions than in the book Zero to One. If you would like to read more about the vision of Peter Thiel I would recommend either reading Zero to One or look into articles of Steve Denning and Omar Ismael whom more accurately portray Thiel’s vision.

The questions are specific enough that they can be answered quickly but complex enough that it can be viewed with different types of business development, strategy and marketing theory. Though, keep in mind that the seven questions do not cover all important aspects a business is confronted with, like for example finance

The engineering question

Is your product or service breakthrough?

Any product or service has a function of solving a problem (want or need) in the present or future. When a breakthrough product arrives in the market it has the potential to capture a large share of the market by just being many times better than any other competing solution.

A breakthrough product or service is, in essence, a product or service that is vastly more superior than any other competing solution in the market. In Thiel’s vision it is something that is at least ten times better than anything else out there.

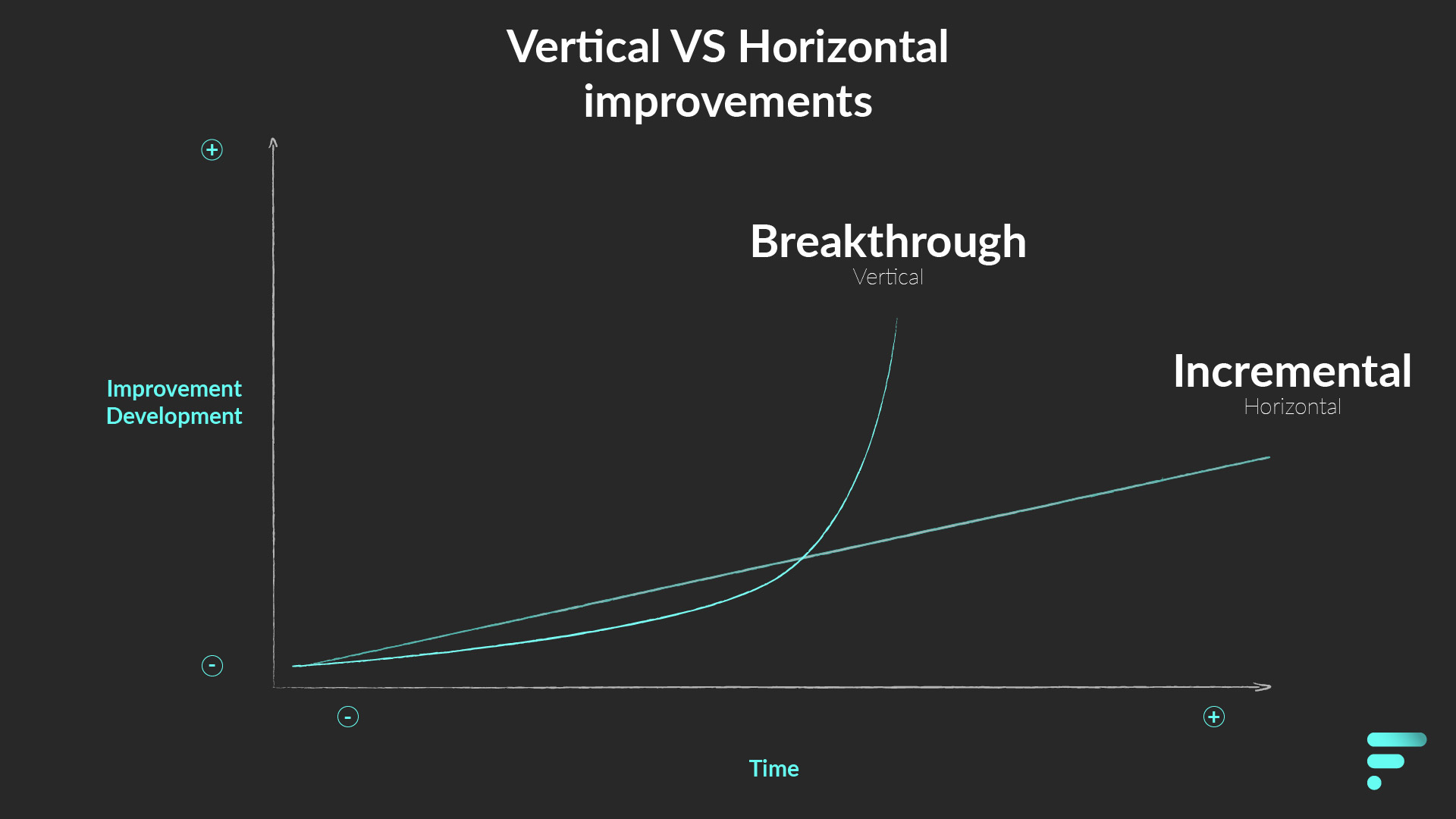

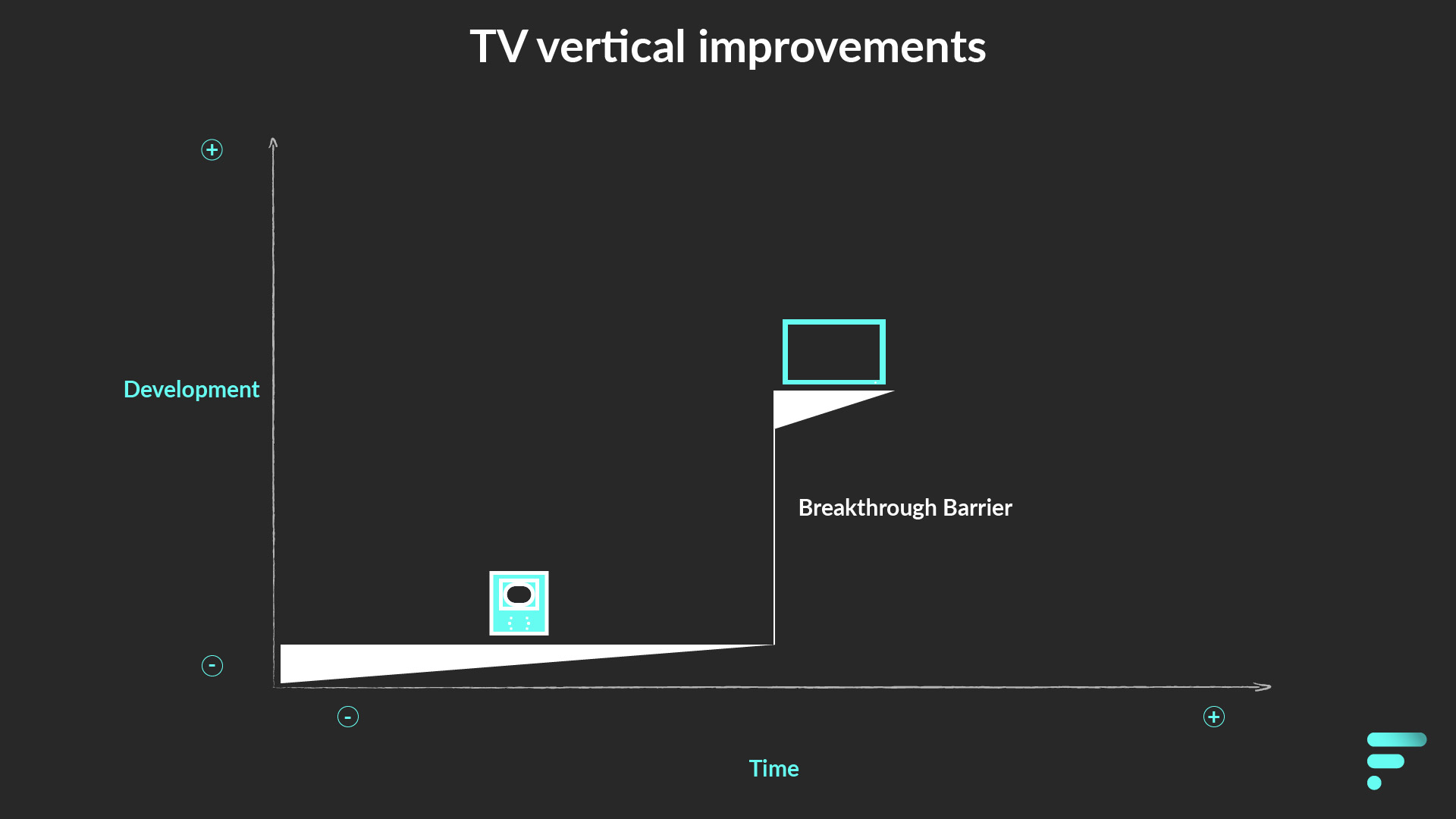

Thiel identifies two different type of product development. One is when companies make incremental steps to improve products (horizontal movement). The other is when something breakthrough has been created, a product that has the potential to create and capture value of customers by radically changing the game (vertical movement).

Needless to say, moving vertically to solve a problem yields better prospects for a business and investors than something that is competing horizontally with already existing products or services.

In marketing terms, you would want to look at the core product (the value customers get by purchasing a product), whereas the augmented and actual product (or the media circus) is irrelevant.

Something that is truly unique, or something that you may create with a morphological box for example, gives you an edge that multiplies and magnifies the success rate when you are able to answer the other questions positively.

Incremental or breakthrough?

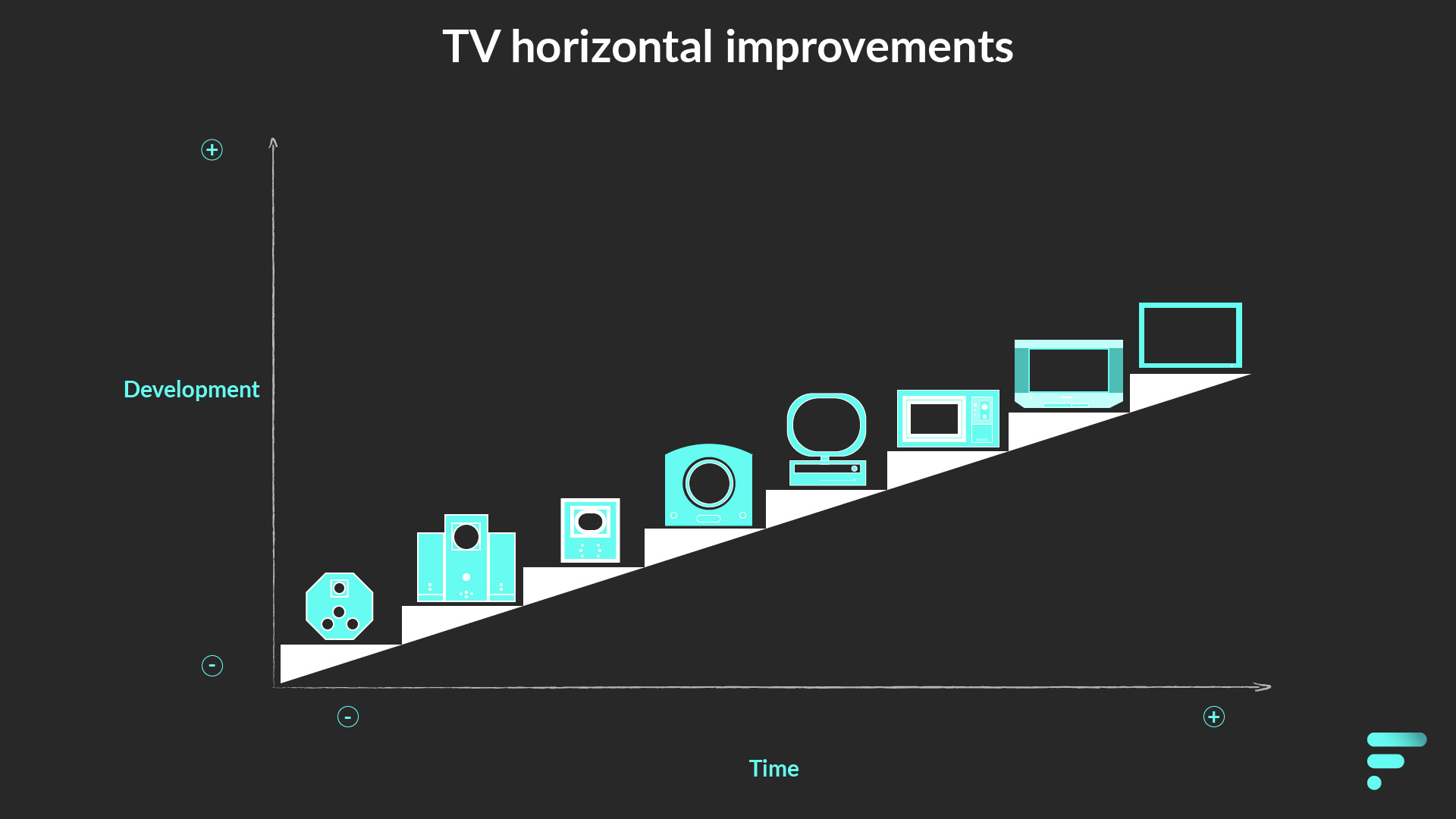

What is incremental has been breakthrough before and what is breakthrough will become incremental later. Technology is a fine example of this development.

Television can be regarded at one point in time as a breakthrough product. When televisions were finally available for the common man, it was far from perfect at the state it launched.

Televisions were expensive to manufacture thus expensive to buy. This affected adoption rate. Moreover, people failed (in hindsight you may agree) to see exactly what benefits a television brought to a family. You could only watch TV for a few hours of the day and you only had one channel.

Despite the product being breakthrough at the time, television manufacturers where not necessarily rolling in money. Yes, they did have a breakthrough product, but the timing may not have been ideal (more on that later).

Whether you may agree or not on the timing of television, it needed to happen then for it to be now a commodity in nearly all households now. People needed to warm-up to the idea of television. A market needed to be made. Once it was more obvious to people what the benefits were, improvements on the product started to look more obvious. Think of more channels, remote controls, color and so on. However, those are incremental steps of a breakthrough product.

Now imagine that television did not experience any incremental steps since it first was launched. That we still had a black and white cubicle that was ridiculously expensive, that nobody could afford. Then suddenly a curved, flat screen, 8K television arrived at a price point that everybody could afford. Impossible? Perhaps. Ten times better? You bet.

An 8K television would perhaps not be one on one breakthrough with what it would replace, but the advance would be so drastic that no competitor could follow the manufacturer (be it by proprietary technology or something else), until it may be too late.

That is what it means to be breakthrough. The potential of capturing the market in one fell swoop. Think of cars replacing horses, email replacing mail or mechanical keyboards replacing writing.

Why is the breakthrough question important?

With a breakthrough product or service, a company will not be competing in core competencies, immediately, with other solutions. By the time a competitor decides to catch-up, there is already a head start and there is a chance for the company to become the last mover and consolidate the market.

This head start generally translates as an advantage over a certain period of time in which a competitor may jump in the fray to catch up on you. Speed is therefore of essence.

Also important, particularly for start-ups, when the product is so clearly better than anything else on the market it makes the costs of customer acquisition lower due to the multiplying effect that a hyped product has. Think of people referring the product, media attention or staff wanting to work for a company.

When answering the breakthrough question positively, it also voids many of the sales aspect young entrepreneurs struggle with. Young entrepreneurs generally struggle with sales and avoid press like the plague. When a product is so obviously superior, that the benefits become transparent, the product has the potential to sell itself – a product will still always need to be sold though. The entrepreneurs can therefore void shady sales tactics like slapping the roof of a car.

Lastly, be wary of the superior product trap. Not everything that is clearly superior or that is unique (read: has never been made before) has a marketable value. What this means, is that even if your product is clearly better, it may not solve a problem better than substitutes in the mind of the target audience. Moreover, it may not even cover a want or need.

Think of it this way, anything that requires changing habits is expensive and difficult to pull-off (in both labor and capital), anything that is clearly better needs to be marketable at the correct price point (Price Elasticity vs COP) and something that is radically new does not per definition mean that there is a market for that.

The timing question

Why now and not earlier or later?

Although it may seem timing is not important when a superior product or service is ready to be launched, timing still plays an important role. Timing the launch of a product or service can make the difference between flopping and succeeding.

Moreover, the timing questions can help avoid mistakes with human and capital investment if you are too late or too early to launch.

Some products came-on too early (e.g. No Man’s Sky), others came too late (e.g. Windows Phone) and others should not exist at all (e.g. Pet Rock’s). Timing can be divided in two phases, namely development time and actual launch.

First, we need to clearly make the difference between launching and developing a product. Products that are thought of today, can still take years to develop. When you think of timing you need to take the actual development into consideration, because the period in between thinking of something and launching something may not align. This may hinder a business into creating a solid business case.

Good example of this are 3D printers. Many analysts saw, and still see it, as one of the most fundamental technological development in the last decade. The uses of 3D printers are indeed myriad, but praising and evangelizing a product does not mean that it becomes available immediately.

It took many years of development (both on software and hardware) for it to be available to the common man (or even companies). In the present though, starting with the thought of developing something in the 3D printing industry, say software, a company would already start at a disadvantage. Because many other companies are working in the shadows for a similar solution (competition) or already have a competing solution.

Although it may not seem like it, launching something too early can be as devastating as coming into the party too late. Continuing with the previous analogy about TVs. How many manufacturers that first started selling TVs are still active now? Nearly none. Most of the companies active now in the industry is what you would call last-movers, companies that have consolidated the market and are competing against each other with little to no room for new-comers.

From idea to launch

Timing wise, launching a product or service may seem as the most important aspect to the timing question. That is absolutely true on many levels. However, that is based on development a product or service with traditional market research, in which a market is gauged beforehand and then something is developed.

However, currently we can skip, more or less, market-research by being able to sell or test before actually manufacturing and delivering something.

Staples of this development are not only crowd-funding websites but also other companies or even industries that have pulled it off. The entertainment industry – or anything that can create hype for that matter – is a good example of this. Going to a concert of your favorite artist, would likely require purchasing a ticket in advance. That does not only happen to services that are perishable, but products as well. Like pre-ordering any digital product like movies or video games.

Needless to say, when you are able to sell before you actually launch, a strong business case can be made.

When is a good time to launch?

There is no correct answer to that question. For some problems having a solution as soon as possible is the best way to go, even if the solution is flawed. When a meteorite is on trajectory to hit earth, any solution would be viable, even if it is not perfect.

A matter of fact, being the first mover can potentially make a company market leader despite of the proposition being flawed. Food-delivery services like Foodora, Deliveroo, Take Away or Uber launched within a short period of each other in Amsterdam. This resulted that no company could gain truly momentum and a head start. To be fair though, there were other companies active in the Netherlands with a similar idea but they could not quite nail down the distribution.

Other situations to figure out when to launch can require market research. Depending on the size of your organization you could use different methods. Like, interviewing potential customers, looking for proxies to compare, doing a survey or even a competitor analysis.

Other options you have is to look at it from an industry perspective, for example with the Gartner hype cycle.

Lastly, entering (or founding) a market as a first mover, comes at a great cost. It requires a great amount of resources to create and exploit a market and a first mover can become an easy target for competitors to overtake. Either attempt to monopolize a small market (next part) or be the last-mover of a larger market.

The monopoly question

What does it take to control the market?

A monopoly is where one producer – a few producers (oligopoly) – controls the market. It is one single company that sells one specific product or service that nobody else sells. Substitutes are not readably available or are not competition worthy.

Generally, governments and economists see it as detrimental when one supplier is the sole supplier of a certain product or service. Monopolies are undesirable for a free market, as it leads to a skewed market. When companies holding a monopoly position are not regulated, they are, for example, able to maximize profits or create barriers for other companies to enter the market.

Some monopolies are owned by government (i.e. public transportation), others are legalized by government (i.e. patents and copyright) and other are regulated by government (i.e. telecommunications in Europe or even the shops on the street). Here is the thing though, no company that has ever existed has admitted that they are a monopoly.

Companies generally do not want to be in the magnifying glass of the public or government. That is why no enterprise will ever want to admit it controls the market.

Thiel makes a sharp observation that when companies get accused of being a monopoly they will deny it on the grounds that they belong to a larger industry than they are actually in. Example of this is Google. Depending on the country you live in and the source you are looking at, Google will likely be the largest search engine platform. However, Google will never admit that they own the search field. They would argue that they are only a tiny part of the advertising industry. Conveniently the advertising industry is many times larger than the search field.

Play monopoly

Perhaps one of the more important notions from Thiel and a very scarce number of economists, is the idea of monopoly. When companies equally own market share and there is a perfect balance of supply and demand, it is impossible to make an economic profit.

Although, this would lead to the best possible distribution of wealth, the reality is that no company takes enough – or trust each other enough – with total balance. Companies compete. The loss of one is the win of the other.

This translates back to product or service being constantly improved to the point that eventually no meaningful improvements are added. The results thereof are that companies do not have any meaningful profit margin compared to the costs of production and delivery. This leads to an industry with saturation and high entry barriers, putting the industry in lock-down.

When an industry seems in lock-down, it generally means it is a big industry where competition is fierce and growing in it is not possible with a sub-par or mediocre alternative. Moreover, these industries require big investments which may not turn into meaningful profit. In addition, wasteful resources are put into watching competition instead of creating something truly breakthrough.

On the other hand, with a monopoly, no company is affected by another. A company controls the market and they can tweak the price-elasticity to meet an economic profit that may seem fit. These companies are driven by their own ideas and beliefs and are generally so unique that they are even able to add true value to society.

How can you control the market?

Start small. The best bet for a company is to enter a small market and try to conquer it. Small markets are not interesting enough for big players to enter and capturing it require less resources than a larger market. However, that does not mean it is something easy to do. Particularly so, for products or services that have not proven a fit with the market.

Targeting a small geographic area and putting a product or service out which is exceptionally good at solving one specific problem, are good ways of creating a monopoly. After that, the next step would be scaling-up to a new geographic area and do the trick once again.

Although, conquering a market is beyond the scope of this article, in most small markets, companies try to fully embody the entire channel, from production to delivery. This article may show you some more insights of why it is important to control the channels.

The reason why companies will try to embody most channels – creating in the process a de facto monopoly – is that when the market grows that specific company will benefit the most from the growth. Even when more competitors jump in. This is a form of scaling-up that is used by market leaders, which is a well-hidden secret for most. Think of Heineken owning tavern barns and forcing the entrepreneurs exploiting it to buy only Heineken beverages. Or Apple owning the App Store.

Lastly, avoid the fallacy of targeting one percent of a trillion-dollar industry. On paper it may seem easy enough but making a dent in a big market can be quite difficult if you are not transparently able to excel at something. Moreover, any company moving into a trillion-dollar industry will be hard pressed to even make a profit, as competition is unequivocally hard.

The people question

Do you have the right team?

Every company needs to have the right team to perform optimally. Even more so with a start-up, as founders and first workers will work towards something that may not bear any results, other than the lauded experience of failure.

Nevertheless, recruiting the right type of people can be tricky depending on what exactly a company is building. Specific jobs require specific individuals. Specific individuals require specific needs to be met. A company may be able to meet those needs or not. That will influence any company’s ability to produce and distribute a product or service.

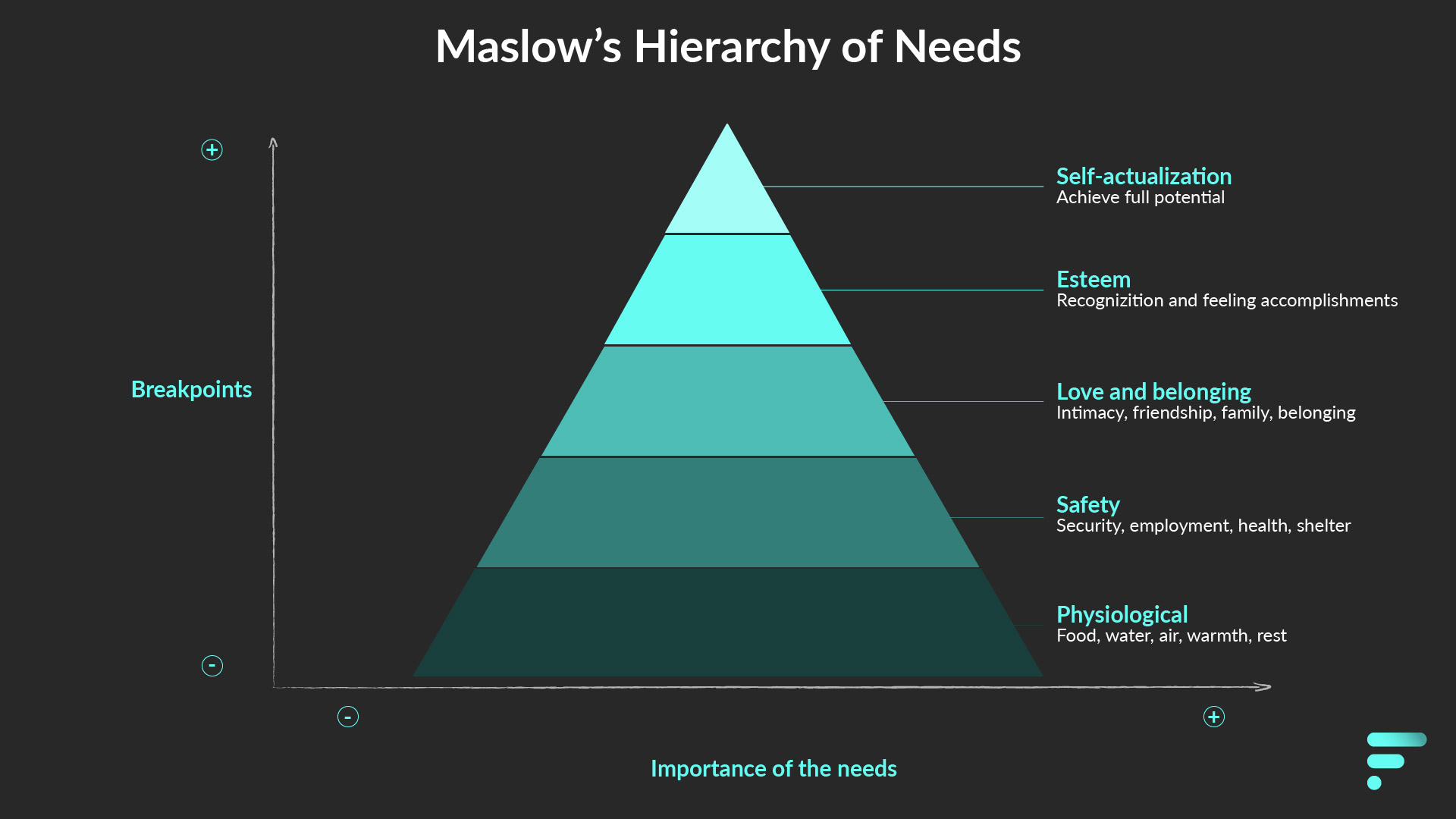

Needs can be viewed as something more than the blunt transaction of remuneration or perks for an individual’s hours. Maslow's hierarchy of needs may shed some more light into the needs that individuals are seeking. Thiel focuses more on the involvement of staff to the company and its vision of solving problems.

This requires that staff look in the distance and take a leap of faith for a vision to thrive. It is true that hardships and sacrifices are made for the long-term vision and people making those sacrifices should be properly compensated. Not necessarily to keep them for long-term, but to avoid misalignment within the team that affects the long-term vision and profits in the future.

Remember, everyone involved in a company is part of the company and should be vested to works towards the end-goal.

The distribution question

How will you sell, market and deliver?

Not everything that is breakthrough will sell by itself. Not necessarily because the product is flawed but because distribution is flawed.

Even more so, company’s that have a distribution advantage can sell more than a product that is better. You can get away with a sub-par product or service if you simply are better at marketing, selling and distributing it.

Great examples can be found in the food industry, where pre-packaged food is seen as the inferior consumable. A restaurant may be able to deliver better food at your doorstep, but – for the sake of distribution – you may buy a pre-packaged meal from a supermarket. The same reason applies to any local ice-creamery. The craft ice cream may be the best you have ever had, but they do not have the distribution to be able to scale, market and sell their product. Unilever does.

Marketing helps get the word out and may generate leads. Leads are tuned into sales and the final step is creating and delivering the product or service. Those three parts are crucial for any company to thrive. When a company does not balance those three parts it generally means that there is waste in one of the departments, be it by too much or too little effort.

The durability question

Will you be able to survive for twenty years?

Looking into a murky future is difficult if you do not have enough industry knowledge or have not payed attention to the development that has occurred in the world. The truth is that when you hear or read about something, like a breakthrough of some kind – which is surely patented –, you are already too late to the party.

Rarely will a company or even a person spill a secret on what they have been working on. When they do spill something about it, publicly that is, they must gain something from it. Sure, crowd-funding generally starts at selling something before producing, but they are after funding and sales and the validation of product market fit, before committing. Moreover, they are sure that they can launch before any competitor with resources can.

The durability question is closely tied to the vision or mission statement of a company. In fact, the answer to the durability question should be found back in those statements. A vision is what a company’s purpose is in the long-term and a mission is the specific steps a company is taking to get to that vision. If the vision does not solve problems in twenty years from now, it is not ambitious enough to validate their business in twenty years from now.

Continuation should not be per definition the goal of a company. The vision should, and all other questions in this article can validate whether a company can survive in twenty years.

In addition, the durability question is the ultimate investor question rather than a long-term survivability question. Not necessarily is it important for equity investors but it is a question for any company or even a person. Will it be worth the time? Will it be worth the effort? Will it be worth the capital?

Durability and business development

When having trouble deciding if an idea can create enough value, the rule of thumb in business development is to not invest time nor equity if you cannot gain a higher interest rate on equity than bonds of your government – likely between 2 and 6 percent. From that percentage you could also reduce the inflation rate the central bank would like to achieve in your country – generally between 2 and 4 percent. If the grand total in percentage is higher than what a company can expect on return, the company or person may as well invest in bonds.

There are a few valid reasons to deviate from that. For example, when a business idea helps a company in attaining a competitive edge (which could translate to a monopoly). Or there is a twenty-year plan with a realistic chance of a rewarding exit. Or the investment is the result of altruistic behavior.

The secret question

What do you know that nobody else does?

Internet has brought a nearly infinite amount of knowledge to the palm of our hands. There is so much information that nothing may seem a secret anymore. Despite that not all information can be categorized as knowledge, there is a certain crave for secrets in society.

Cravings that translate into ideas or information not many people agree to or something that comes from under a tin foil hat. The results and effects thereof can be scrutinized in a myriad of ways, however, how are those ideas translated to concrete business secrets.

The truth is that some secrets are right under our noses but have never been exploited because it requires effort that may not align with the view of an individual. In that sense exploiting a secret can become fast an act of altruism, which gets quickly dismissed because it is not worth the time. Or, if someone is willing to act to it, a cash cow.

The fact is that most conventional marketing books of authors like marketing godfather Kotler, will urge you to look at problems that you have on your day to day life. Figure out if it is something other people struggle with too. Then offer a solution to that problem at a price point people want to pay for the problem to go away. Is there a secret to that? Maybe, but is that truly a well-hidden secret?

There are different categories of secrets and Thiel asks two specific questions that may shed truth to the obscurity and secrecy of a grand plan:

What company is nobody building?

And

Have you identified a unique opportunity that others do not see?

Quality of a secret

Imagine a group of teenagers in their late teens that are walking around a city. They see a few sportscars and are fascinated by it. They wonder how they can get one too. They start thinking through a multitude of ways how it would be possible for them to be in the driver’s seat. They spar ideas around like winning the lottery, saving money, getting a loan or even just stealing one. Among all those options they disassociate that the person driving the car knows something they do not. The teens never wonder about what that could be. However, the person driving the car is exploiting his or her secret and that is the difference.

It would be easy enough for the teenagers to approach the driver and simply ask what the difference is. But even knowing is in some cases not valuable enough to do something with it. You see, even by having a basic understanding of something does not mean you are able to exploit it. Timing is in that sense the true guardian of secret and knowledge. The sooner you have unique knowledge the faster you need to move to exploit it.

Some secrets are hidden in plain sight and others take years or even decades to develop. However, both will lose value quickly if they are not exploited.

The quality of a secret can probably best be assessed by figuring out how many people know about that secret. If it is a shared knowledge, it will be difficult to exploit. Like selling an add and subtract master-class to mathematicians. However, if the knowledge is not readably available you have more options to exploit it and it becomes exponentially more valuable.

How to deal with a secret

The truth is that you must find the right balance of what to do with the secret. In business, the most important part is how do you communicate that secret. That is, how far do you have to go into details to be able to sell something.

The consensus for that dilemma is to tell as little as possible to as little people as possible but just enough to get your project started. Ultimately that would mean to avoid telling details in situations where it does not help. This may sound like something obvious. However, veterans are able to dissect an entire business case by just asking a few questions and persuading someone to tell more about it. This is particularly important for people whom are excited about their project to understand.

In case a company is seeking funding to exploit a secret, that company will, particularly for start-ups, have to spill the beans. No investor will invest in something that is unknown. In matter of fact, little to no investors will even sign a non-disclosure agreement either. Whether that is good or bad, is a call of the entrepreneur. Keep in mind that some investors have industry knowledge and can help a company move forward. They can also deter a company from moving forward, depending on what they have on their agenda or if they see it as a valuable secret or not.

Share this Page